Matt DiLallo, The Motley Fool

·5 min read

I love investing in dividend-paying stocks. I really like seeing the passive income from those payments flow into my portfolio, giving me more cash to buy shares of companies that pay dividends. I believe my love of dividends will pay off by eventually supplying enough passive income so I can comfortably retire.

While I own lots of dividend stocks, Realty Income (NYSE: O), Brookfield Infrastructure (NYSE: BIPC) (NYSE: BIP), and Clearway Energy (NYSE: CWEN) (NYSE: CWEN.A) are three of my favorites. Here's why other dividend lovers will love these stocks too.

A remarkably consistent grower

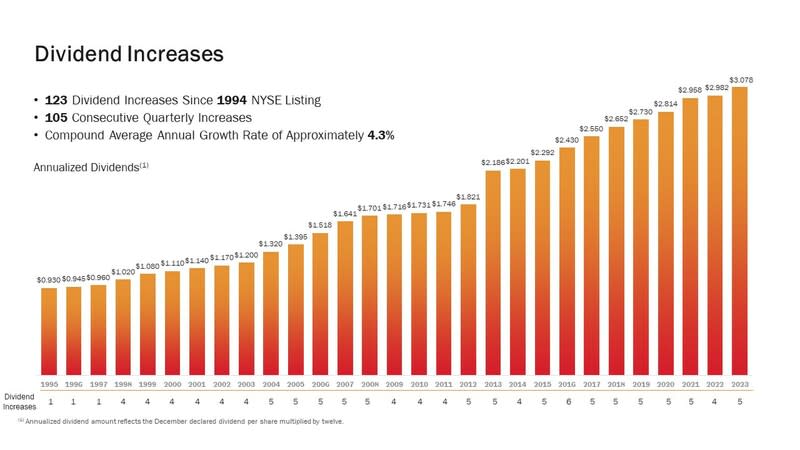

Realty Income has lavished dividends on its investors over the years. The real estate investment trust (REIT) has made 643 monthly dividend payments throughout its history. It has increased its dividend payment 123 times since going public in 1994, including for the last 105 straight quarters, growing its payout at a 4.3% compound annual rate.

The REIT expects to continue growing its attractive dividend (currently yielding 5.8%). It's targeting to grow its adjusted funds from operations (FFO) by 4% to 5% per share over the long term. Given its already conservative dividend payout ratio (75.1% of its adjusted FFO in the third quarter) and fortress-like balance sheet, it should be able to grow its dividend at or above the low end of that rate. The company's strong financial profile allows it to continue acquiring income-producing properties.

Realty Income has already closed two notable deals this year. It bought fellow REIT Spirit Realty in a $9.3 billion deal. That transaction will increase its adjusted FFO by more than 2.5% per share this year. Meanwhile, it recently bought a portfolio of retail properties from Decathlon for over $500 million. These and future acquisitions will grow its adjusted FFO, enabling the REIT to continue increasing its dividend.

Marching higher

Brookfield Infrastructure recently announced its 15th consecutive annual dividend increase. The global infrastructure operator boosted its payout by another 6%. Over the past decade, it has grown its payout at an 8% compound annual rate. Brookfield's dividend now yields an enticing 4.4%.

The company plans to increase its payout at a 5% to 9% annual rate over the long term. It has plenty of power to achieve that plan. It has a trio of organic growth drivers (rates indexed to inflation, volume growth as the global economy expands, and expansion projects) that should drive 6% to 9% annual FFO-per-share growth.

Brookfield believes acquisitions could drive even faster FFO-per-share growth. For example, it grew its FFO by 10% in 2023, 8% organically, and the other 2% fueled by new investments. Acquisitions could provide an even bigger boost this year, given the timing of last year's deals (it closed $2 billion in the third and fourth quarters, partially offset by $1.9 billion of asset sales in the second quarter).

Meanwhile, it has lined up two more deals for this year. It's buying some data centers out of bankruptcy and a portfolio of cell towers in India from American Tower. These and future new investments will give the company even more power to increase its dividend.

A fully powered dividend growth plan

Clearway Energy expects to grow its already alluring dividend (6.8% yield) toward the upper end of its 5% to 8% annual target range through 2026. The renewable energy producer has already locked in the growth it needs to deliver on the plan.

The main power source is its capital recycling strategy. Clearway cashed in on the value of its thermal assets in 2022, netting over $1.3 billion in cash proceeds. It has found deals to redeploy that cash into higher-returning renewable energy investments. Those investments will grow its cash flow, enabling it to increase its dividend. The company expects its cash available for distribution to rise from $330 million-$360 million last year to $435 million once it closes all the new investments it has secured.

Meanwhile, Clearway Energy has plenty of power to continue growing its payout beyond 2026. Recent contract renewals for its natural gas power plant portfolio are coming in at a high enough rate that these agreements alone could support dividend growth at the low end of its target range in 2027. On top of that, the company has the financial flexibility to continue acquiring new renewable energy projects as opportunities arise.

Dividend stocks investors can love

Realty Income, Brookfield Infrastructure, and Clearway Energy offer dividend lovers the two things they love most: high yields and visible growth. They currently offer yields several times above the S&P 500 (1.4%) and expect to grow those payouts at a single-digit annual rate. That combination should also enable these stocks to produce compelling total annualized returns that could reach double digits. This makes them great stocks for dividend lovers to buy right now.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service hasmore than tripledthe return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Matt DiLallo has positions in American Tower, Brookfield Infrastructure, Brookfield Infrastructure Partners, Clearway Energy, and Realty Income. The Motley Fool has positions in and recommends American Tower and Realty Income. The Motley Fool recommends Brookfield Infrastructure Partners and recommends the following options: long January 2026 $180 calls on American Tower and short January 2026 $185 calls on American Tower. The Motley Fool has a disclosure policy.

3 Dividend Stocks That Dividend Lovers Will Love was originally published by The Motley Fool