Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

alternative-investmentscfa-level-2

07 Nov 2023

Hedge funds are a complex aspect of alternative investments, with advantages and disadvantages. The fundamental dilemma is whether the additional fees associated with hedge fund investments are justified by the potential for increased returns (alpha) and portfolio diversification. This debate continues within the industry.

Proponents argue that hedge funds provide access to top-tier investment talent and the potential for alpha generation, especially in challenging markets. Critics highlight issues such as high fees, complex documentation, limited transparency, more extended investment commitment periods, and various portfolio risks introduced by different hedge fund strategies.

Some strategies enhance portfolio diversification, while others primarily boost returns without providing genuine diversification. Additionally, the hedge fund industry has evolved with the emergence of liquid alternatives (liquid alts) that aim to offer daily liquidity, transparency, and lower fees. However, these liquid alts often underperform traditional hedge funds.

Investors should be aware of the nuances of hedge fund investing. Although hedge strategies may be less crucial in bull markets compared to the mid-to-late 2000s, their popularity tends to follow cyclical patterns. As the endowment investing model demonstrates, including hedge funds in a portfolio can enhance returns and reduce risk.

Classification of Hedge Funds and Strategies

Legal/ Regulatory overview: Various countries have different eligibility requirements for investors looking to access hedge funds. These regulations restrict access to traditional hedge funds to financially sophisticated investors who meet specific income or net-worth criteria. They also limit the number of subscriptions hedge fund managers can accept. Most traditional hedge funds are offered as private placements in the United States. Whether the fund manager needs to register with regulatory authorities depends on their assets under management, but all U.S. hedge funds are subject to regulatory oversight to prevent fraudulent behavior. Hedge funds in other jurisdictions, such as tax-friendly locations like the Cayman Islands, the British Virgin Islands, or Bermuda, are typically presented as separate corporate entities subject to local rules and regulations.

Over the past decade, the introduction of liquid alternative funds (liquid alts) has brought significant regulatory changes to the hedge fund industry. Many hedge fund strategies, like long/short equity and managed futures, are available in mutual fund-type structures. These are accessible to retail investors and allow daily redemptions. Unlike traditional hedge funds, they can’t charge incentive fees.

Overall, hedge funds face fewer regulatory constraints than regulated investment vehicles, except liquid alts, which have more stringent requirements to ensure investor liquidity.

Flexible mandates and few investment constraints: Hedge funds enjoy a high degree of flexibility due to their limited legal and regulatory constraints. They have significant freedom in their trading and investment activities, allowing them to invest in various asset classes and securities, manage risk exposures, and use collateral as needed. The fund’s prospectus or offering memorandum outlines the guidelines for a hedge fund’s activities, including any restrictions on specific asset classes, leverage, shorting, and derivatives.

Extensive Array of Investment Options: Reduced regulatory limitations and adaptable directives allow hedge funds to enter a broad spectrum of assets beyond the standard selection of conventional investments. This encompasses private securities, non-investment-grade debt, distressed securities, derivatives, and even more unconventional contracts like life insurance policies and royalties from music or film.

Daring Investment Approaches: With their flexible investment mandates, Hedge funds often employ strategies considered too high-risk for conventional investment funds. These strategies frequently include extensive shorting and concentrated positions in domestic and foreign securities, exposing them to credit, volatility, and liquidity risk premiums.

Moderate Leverage Utilization: Hedge funds leverage more than conventional investment funds. Leverage can be applied through borrowing securities or using derivatives. Maximizing returns in some strategies and hedging against specific risks in others, even if it increases the notional leverage, is essential. In quantitative long/short equity trading, leverage is frequently used to exploit minor valuation anomalies over short periods while attempting to maintain market neutrality.

Liquidity Restrictions in Hedge Funds: Limited partnership hedge funds impose initial lock-up periods, liquidity gates, and specified exit opportunities. These mechanisms give hedge fund managers more control over their investment positions than vehicles that permit investors to withdraw their funds anytime. Consequently, it is unsurprising that empirical data indicates that privately placed hedge funds tend to outperform similar-strategy liquid alternative products by an average of approximately 100 to 200 basis points per year.

Elevated Fee Arrangements: Hedge funds have typically charged investors higher fees, encompassing management fees of 1% or more of assets under management (AUM) and incentive fees ranging from 10% to 20% of annual returns. The incentive fee structure is designed to align the interests of hedge fund managers with those of the fund’s investors.

Hedge fund classification

- Single manager fund: A fund where either an individual portfolio manager or a team of portfolio managers focuses their investments on a single strategy or style.

- Multi-strategy fund: A type of multi-manager fund where multiple teams of portfolio managers engage in trading and investments across various strategies within a single fund.

- Fund-of-funds (FoF): A multi-manager fund in which the fund-of-funds manager allocates capital to distinct underlying hedge funds, which can include single-manager and multi-manager funds, each of which operates a diverse array of investment strategies.

Prominent hedge fund data vendors utilize various criteria to categorize hedge fund strategies. For instance, Hedge Fund Research, Inc. (HFR) classifies funds into six main single strategy groupings: equity hedge, event-driven, fund-of-funds, macro, relative value, and risk parity. Lipper TASS, another well-known data vendor, classifies funds into ten categories: dedicated short bias, long/short equity hedge, and global macro. Morningstar CISDM refines this classification with sub-categories like merger arbitrage and systematic futures.

Eurekahedge, a significant index provider, offers nine main strategy indexes, covering areas like arbitrage and distressed debt. On the other hand, Credit Suisse uses a different approach, with nine sub-indexes reflecting strategies like convertible arbitrage and managed futures.

These data providers employ diverse methodologies for index calculation, resulting in variations in index performance. While some indices are equally weighted, others are weighted by fund size. It’s worth noting that there’s limited overlap in manager reporting among these providers, with less than 1% of hedge fund managers reporting to all of them.

In line with these data vendor groupings and a practice-based risk factor perspective, hedge fund strategies can be broadly categorized into six groups: equity, event-driven, relative value, opportunistic, specialist, and multi-manager.

- Equity-related hedge fund strategies: Primarily concentrate on equity markets, with most of their risk profiles tied to equity-related risks. The primary strategies within this equity-related category, which will be explored further, include long/short equity, dedicated short bias, and equity market neutral.

- Event-driven hedge fund strategies:Center around corporate events, encompassing governance events, mergers and acquisitions, bankruptcies, and other pivotal occurrences within corporations. The central risk for these strategies is event risk, where unforeseen events can adversely affect a company or security. Such unexpected events may involve unanticipated corporate reorganizations, unsuccessful mergers, credit rating downgrades, or bankruptcies. The most prevalent event-driven hedge fund strategies, merger arbitrage, and distressed securities will be thoroughly examined.

- Relative value hedge fund strategies: Center on assessing the relative valuation between two or more securities. These strategies frequently entail exposure to credit and liquidity risks, as the valuation variances they aim to capitalize on often stem from differences in credit quality and liquidity among various securities. The two primary relative value hedge fund strategies to be explored in more detail are fixed-income arbitrage and convertible bond arbitrage.

- Opportunistic hedge fund strategies: Adopt a top-down perspective, concentrating on a diversified opportunity set, often with a macroeconomic orientation. The risks associated with opportunistic hedge fund strategies hinge on the specific opportunity set they target and may fluctuate over time and across various asset classes. The two prevalent opportunistic hedge fund strategies covered in greater depth are global macro and managed futures.

- Specialist hedge fund strategies: Center on distinctive or specialized opportunities, frequently demanding specific expertise or market knowledge. These strategies may encounter distinctive risks from particular market sectors, specialized securities, or esoteric financial instruments. Two specialized strategies involving options (volatility strategies) and reinsurance will be investigated more comprehensively.

- Multi-manager hedge fund strategies: These are centered around constructing a diversified portfolio comprising various hedge fund strategies. Managers within this category employ their expertise to blend diverse strategies and make dynamic reallocations over time. The two prevalent types of multi-manager hedge funds, multi-strategy, and fund-of-funds, will be examined in more detail.

Question

Which of the following can most appropriately be classified as a relative value fund strategy?

- Merger arbitrage.

- Global macro.

- Fixed income arbitrage.

Solution

The correct answer is C.

Relative value hedge fund strategies center on assessing the relative valuation between two or more securities. These strategies frequently involve exposure to credit and liquidity risks, as the valuation disparities they aim to capitalize on often stem from variations in credit quality and liquidity among different securities. The primary relative value hedge fund strategies are fixed-income and convertible bond arbitrage.

A is incorrect. It’s an event-driven merger strategy.

B is incorrect. It’s an opportunistic hedge fund strategy.

Reading 38: Hedge Fund Strategies

LOS 38 (a) Discuss how hedge fund strategies may be classified.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

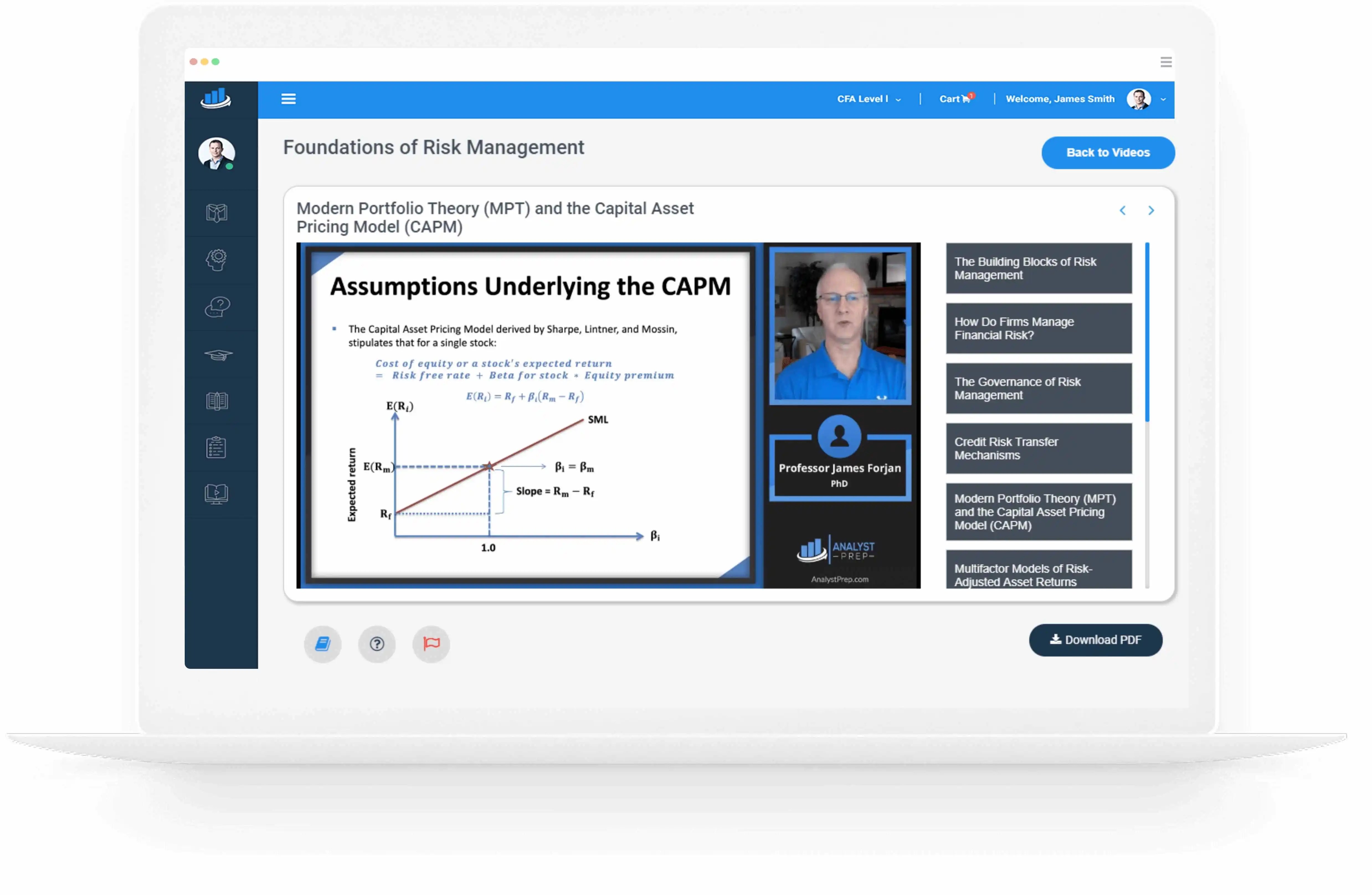

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts