Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

alternative-investments

07 Mar 2024

Alternative Investment Methods

Investors have three primary methods of accessing alternative investments. These methods are:

- Fund Investment: This is the first method where investors put their money into a fund, such as a Private Equity (PE) fund. For instance, an investor might choose to invest in the Blackstone Group, a well-known PE fund.

- Co-Investment: In this method, the investor invests in a fund’s portfolio company. For example, an investor might co-invest in a promising start-up with a venture capital fund like Sequoia Capital.

- Direct Investment: Here, the investor invests directly into a company or project, such as infrastructure or real estate. For instance, an investor might directly invest in a real estate project like a new residential complex in New York City.

Typically, investors start their journey in alternative investments via funds. As they gain more experience and knowledge, they may start to explore co-investing and direct investing.

Fund Investment

Investors, especially those with limited resources or experience, often choose fund investing as a means to participate in alternative investments. In fund investing, investors contribute capital to a fund, and the fund’s management takes care of the investments on their behalf.

The investor is then charged a management fee and, if the fund manager delivers superior results compared to a benchmark or hurdle rate, a performance fee. The investment decisions of fund investors are limited to either investing in the fund or not. Fund investing is available for all major alternative investment types, including hedge funds, private capital, real estate, infrastructure, and natural resources.

Investing in alternative assets requires specialized skills that many investors do not have. For instance, investing in real estate requires knowledge about property valuation, legal issues, and market trends, which a typical investor may not have. Such investors can gain exposure to these assets through fund investing. In this method, one or more investors contribute capital to an investment management company that identifies, selects, manages, and monitors investments on behalf of the investors.

Comparing Fund Investment with Traditional Public Equity and Fixed Income

Fund investment structures for alternative investments differ significantly from traditional public equity and fixed-income fund or ETF investments:

- Alternative funds usually involve the pre-commitment of funds before investment selection and an extended lock-up period during which the fund cannot be liquidated.

- Investment structures for alternative funds typically come with higher management fees and intricate fee arrangements. Unlike equity or fixed-income funds, these structures often provide less frequent transparency regarding periodic returns and fund positions.

- Investors in alternative funds usually compensate managers using a performance-based fee structure to better align manager and investor incentives over extended periods.

Advantages of Fund Investment

- Fund investing requires less investor involvement compared to direct and co-investing.

- The alternative investment option is accessible to anyone, regardless of their expertise.

- Diversification benefits come from the multiple investments found in a single fund.

- It requires a low minimum capital compared to the other investments.

Disadvantages of Fund Investment

- It is costly since an investor must pay management and performance fees.

- An investor is expected to conduct due diligence when selecting the appropriate fund.

- There are exit restrictions due to lockups and similar limitations.

Co-investment

Co-investing is a strategic method of investment where an investor diversifies their investment approach by investing in assets both indirectly through a fund and directly in the same assets. This is achieved by obtaining co-investment rights. For instance, if a private equity fund is investing in a startup, an investor with co-investment rights could also directly invest in that startup alongside the fund.

Co-investing allows an investor to participate in a deal identified by a fund, not just by investing in the fund itself. This method of investment provides an opportunity for investors to expand their investment knowledge, skills, and experience beyond what they would gain from a fund-only investment approach.

Advantages of Co-investing

- An investor can learn from the fund’s expertise and improve at direct investing.

- Investors co-invest an additional amount into an investment, often without paying management fees on the capital they used for direct investments.

- Co-investing allows investors to be more actively involved in managing their portfolios than fund investing.

Disadvantages of Co-investing

- Co-investors have limited control over the investment selection process compared to direct investing.

- It may be subject to adverse selection. A fund may offer less attractive investment opportunities to the co-investor while allocating capital to more appealing deals.

- Co-investing requires an investor to be more actively involved since they must evaluate both investment opportunities and the fund manager.

Benefits of Co-Investment for Managers

Managers also benefit from choosing one or more co-investors. The benefits include:

- Accelerating Investment Timing: When available funds and expected inflows are insufficient for a specific deal, co-investors can provide the additional capital needed to expedite the investment. For instance, if a hedge fund manager identifies a lucrative investment opportunity but lacks sufficient funds, they can bring in co-investors to quickly secure the deal.

- Expanding Investment Opportunities: Co-investing can expand the scope of available new investments. By pooling resources with co-investors, managers can access larger, more diverse investment opportunities that they might not be able to afford on their own.

- Increasing Diversification: Co-investing can help increase the diversification of an existing pool of fund investments. By bringing in co-investors, managers can spread the risk across a wider range of assets, reducing the potential impact of any single investment’s poor performance.

Direct Investment

Direct investing is a method employed by large, sophisticated investors who possess the necessary skills and knowledge to manage individual alternative investments. This approach eliminates the need for an intermediary, providing the investor with maximum flexibility and control over their investment choices, financing methods, and timing. For instance, a billionaire investor like Warren Buffet might directly invest in a company like Apple, buying shares directly from the market instead of going through a mutual fund or an ETF.

Private Equity and Direct Investing

In the context of private equity, direct investing involves the acquisition of a direct stake in a private company. This is done without the use of a fund managed by an external asset manager or general partner.

The direct investor must have the resources to provide the specialized knowledge, skills, and oversight capabilities that direct investment requires. For example, a venture capitalist might directly invest in a startup, taking a significant stake in the company and actively participating in its management and decision-making process.

Direct Investing in Other Sectors

While the direct investment approach is commonly applied to private capital and real estate, it is also used by some very large investors, such as pensions and sovereign wealth funds, for direct investment in infrastructure and natural resources.

Advantages of Direct Investment

- An investor avoids paying ongoing management fees to an external manager.

- Direct investing allows an investor to create a portfolio of investments that suits their needs.

- Direct investing provides an investor with the utmost flexibility and control over their investment.

Disadvantages of Direct Investment

- Direct investing requires a greater level of investment expertise.

- A direct investor won’t enjoy the diversification benefits of fund investing.

- Direct investing requires more significant levels of due diligence because of the absence of a fund manager.

- Compared to fund investing, it requires a higher minimum capital.

Question #1

Which of the following is least likelya potential benefit for the manager in choosing to co-invest?

- Reducing the need for active management of the investment.

- Expanding the scope of available new investments by pooling resources.

- Accelerating the timing of the investment when available funds are insufficient.

The correct answer is A.

Reducing the need for active management of the investment is not a potential benefit for the hedge fund manager in choosing to co-invest. Co-investment does not necessarily reduce the need for active management. In fact, it may increase the need for active management due to the complexity of managing multiple investors and their expectations.

Co-investment can bring additional resources and capital, but it also brings additional responsibilities and potential conflicts of interest. The manager will still need to actively manage the investment to ensure that it is performing as expected and to manage the relationships with the co-investors. Therefore, reducing the need for active management is not a benefit of co-investment for the hedge fund manager.

B is incorrect. Expanding the scope of available new investments by pooling resources is also a potential benefit of co-investment. By pooling resources with co-investors, a hedge fund manager can potentially access larger or more diverse investment opportunities that would be out of reach if the manager were investing alone. This can help to diversify the investment portfolio and potentially increase returns.

C is incorrect. Accelerating the timing of the investment when available funds are insufficient is indeed a potential benefit of co-investment. If a hedge fund manager has identified a lucrative investment opportunity but does not have sufficient funds to take full advantage of it, bringing in co-investors can provide the additional capital needed to make the investment sooner rather than later.

Question #2

An investor with co-investment rights is considering directly investing in a startup alongside a private equity fund. Which of the following is most likelya potential drawback that the investor should consider?

- Co-investing does not provide any learning opportunities.

- Co-investing requires more active management, which can increase costs.

- Co-investing does not allow the investor to participate in a deal identified by a fund.

The correct answer is B.

Co-investing requires more active management, which can increase costs. When an investor co-invests alongside a private equity fund, they are taking on a more active role in the investment. This means that they will need to dedicate more time and resources to managing the investment, which can increase costs. This is in contrast to investing in a private equity fund, where the fund manager takes on the responsibility of managing the investments.

The investor will need to conduct their own due diligence, negotiate terms, monitor the investment, and potentially take on a role in the management of the startup. All of these activities require time and expertise, which can increase the cost of the investment. Therefore, while co-investing can provide potential benefits such as increased control and potentially higher returns, it also comes with increased costs and responsibilities.

A is incorrect. Co-investing can provide significant learning opportunities. By taking on a more active role in the investment, the investor can gain a deeper understanding of the business and the industry. This can be a valuable experience that can be applied to future investments. Therefore, the statement that co-investing does not provide any learning opportunities is incorrect.

C is incorrect. Co-investing does allow the investor to participate in a deal identified by a fund. In fact, this is one of the main benefits of co-investing. The investor can leverage the expertise and deal-sourcing capabilities of the private equity fund while also having the opportunity to invest directly in the startup. Therefore, the statement that co-investing does not allow the investor to participate in a deal identified by a fund is incorrect.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Sergio Torrico

2021-07-23

Excelente para el FRM 2Escribo esta revisión en español para los hispanohablantes, soy de Bolivia, y utilicé AnalystPrep para dudas y consultas sobre mi preparación para el FRM nivel 2 (lo tomé una sola vez y aprobé muy bien), siempre tuve un soporte claro, directo y rápido, el material sale rápido cuando hay cambios en el temario de GARP, y los ejercicios y exámenes son muy útiles para practicar.

diana

2021-07-17

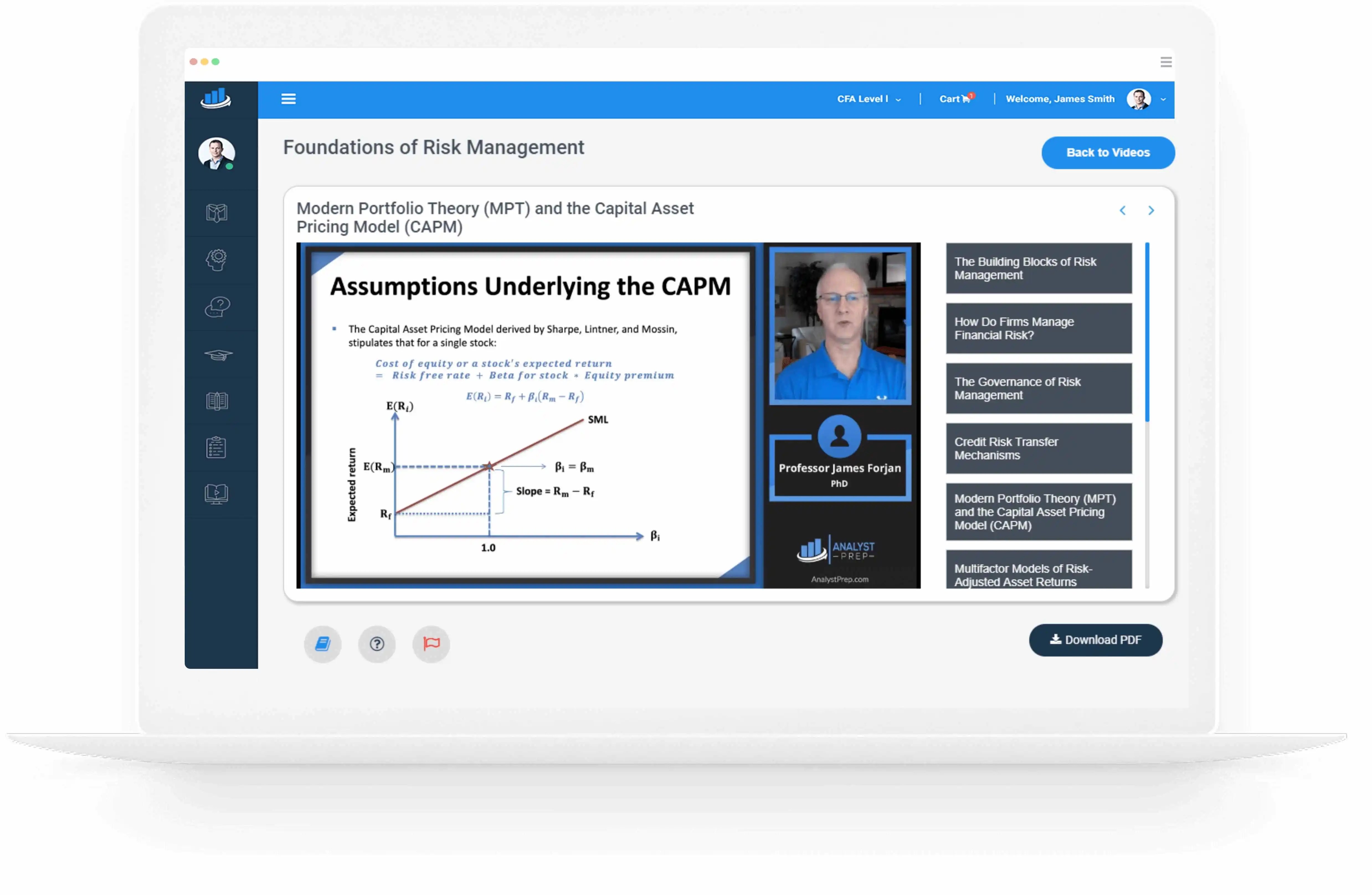

So helpful. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.I usually watch the videos before going into more in-depth reading and they are a good way to avoid being overwhelmed by the sheer volume of content when you look at the readings.

Kriti Dhawan

2021-07-16

A great curriculum provider. James sir explains the concept so well that rather than memorising it, you tend to intuitively understand and absorb them. Thank you ! Grateful I saw this at the right time for my CFA prep.

nikhil kumar

2021-06-28

Very well explained and gives a great insight about topics in a very short time. Glad to have found Professor Forjan's lectures.

Marwan

2021-06-22

Great support throughout the course by the team, did not feel neglected

Benjamin anonymous

2021-05-10

I loved using AnalystPrep for FRM. QBank is huge, videos are great. Would recommend to a friend

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Trustpilot rating score: 4.5 of 5, based on 69 reviews.

Related Posts