Skip to content

- Tutorials

- Python Tutorial

- Taking Input in Python

- Python Operators

- Python Data Types

- Python Numbers

- Python String

- Python Lists

- Python Tuples

- Sets in Python

- Python Dictionary

- Python Loops and Control Flow

- Python Conditional Statements

- Python Loops

- Python Functions

- Python OOPS Concept

- Python Data Structures

- Python DSA

- Linked List

- Stack

- Queue

- Tree

- Heap

- Hashing

- Graph

- Sets

- Map

- Advance Data Structure

- Sorting Algorithms

- Searching Algorithms

- Python Exception Handling

- Python File Handling

- Python Exercises

- Python List Exercise

- Python String Exercise

- Python Tuple Exercise

- Python Dictionary Exercise

- Python Set Exercise

- Python Design Patterns

- Python Programming Examples

- Python Practice Questions

- Java

- Java Programming Language

- Java Tutorial

- Data Types

- Variables

- Operators

- Flow Control in Java

- Loops in Java

- Methods

- Strings

- Arrays

- OOPs Concepts

- OOPs Concepts

- Classes and Objects

- Access Modifiers

- Inheritance

- Abstraction

- Encapsulation

- Polymorphism

- Interface

- Packages

- Multithreading

- File Handling

- Regular Expression

- Java Collections

- Java Collections

- Collection Class

- List Interface

- ArrayList

- LinkedList Class

- Queue Interface

- Set Interface

- HashSet Class

- Map Interface

- HashMap Class

- HashTable Class

- Iterator

- Comparator

- Collection Interview Questions

- Java 8 Tutorial

- Java Programs

- Java Programming Examples

- Java Array Programs

- Java String Programs

- Java Date-Time Programs

- Java File Handling Programs

- Java Collection Programs

- Java JDBC Programs

- Java Apache POI Programs

- Java OpenCV Programs

- Java Interview Questions

- Java Interview Questions

- Core Java Interview Questions-Freshers

- Java Multithreading Interview Questions

- OOPs Interview Questions and Answers

- Java Exercises

- Java Quiz

- Java Quiz

- Core Java MCQ

- Java Projects

- Advance Java

- Spring Tutorial

- Spring Boot Tutorial

- Spring Boot Interview Questions

- Spring MVC Tutorial

- Spring MVC Interview Questions

- Hibernate Tutorial

- Hibernate Interview Questions

- Java Programming Language

- Programming Languages

- C

- C++

- JavaScript

- PHP

- R Tutorial

- C#

- SQL

- Scala

- Perl

- Go Language

- Kotlin

- System Design

- System Design Tutorial

- What is System Design

- Key Terminologies in System Design

- Analysis and Architecture of Systems

- Scalability in System Design

- Databases in System Design

- High Level Design or HLD

- Low Level Design or LLD

-

-

- Accountancy

- Business Studies

- Economics

- Organisational Behaviour

- Human Resource Management

- Entrepreneurship

- Marketing

- Income Tax

- Finance

- Management

- Commerce

Open In App

Last Updated : 07 May, 2024

Journal is a book in which all the transactions of a business are recorded for the first time. Every transaction affects two accounts, one is debited and the other one is credited. ‘Debit’ (Dr.) and ‘Credit’ (Cr,) are the two terms or signs used to denote the financial effect of any transaction. The format of Journal Entry is prepared with 5 columns starting from Date, Particulars, Ledger Folio (LF), Debit Amount & Credit Amount. The word ‘journal’ has been derived from the French word ‘JOUR’ meaning daily records. Journal Book is maintained to have prime records for small firms. After preparing the journal book, the transactions are then posted to Ledger.

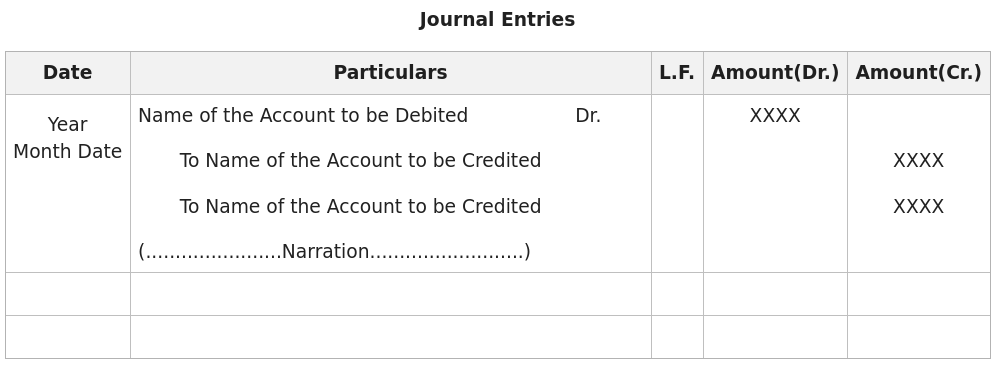

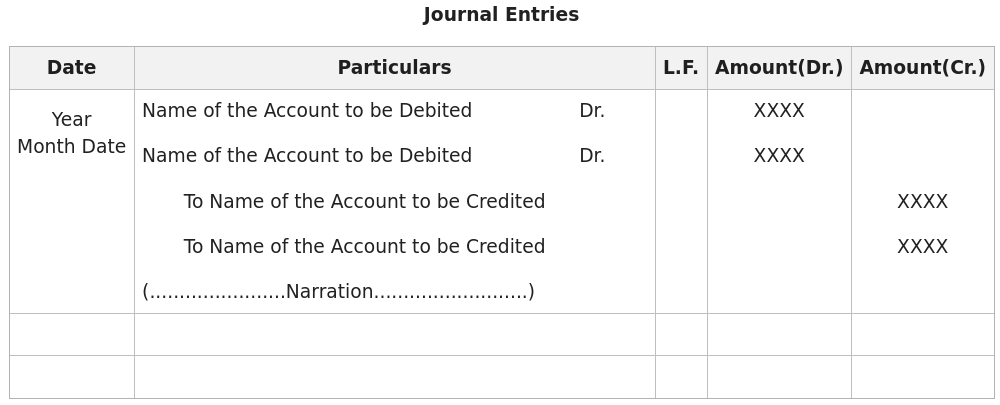

Format of Journal Entry

1. Simple Journal Entry

2. Compound Journal Entry

Or

Or

Columns in the Format of Journal Entry

1. Date: In this column, the date on which the transaction was recorded is mentioned. The year is written at the top, following the month and then the day.

2. Particulars: Every transaction affects at least two accounts. One is debited and the other one is credited. The item that is debited is mentioned first and the word ‘Dr.’ is also written after that. In the next line, the item which is credited is written, a few spaces away from the margin, starting with ‘To’.

Narration- After every journal entry, a brief explanation of the transaction with necessary details is given.

3. Ledger Folio or LF: Ledger Folio shows the number of the page on which the ledger account of that particular item is made.

4. Amount (Dr.): The amount that is debited is mentioned here.

5. Amount (Cr.): The amount that is credited is mentioned here.

Must Read: Journal Entries in Accounting with Examples

Next Article

Ledger Format

Please Login to comment...

Similar Reads

Journal Entry for Loan Given Businesses can also provide loans to any person or entity. A. Loan is given to a person: Journal Entry: Example: A loan of ₹5,000 has been provided to Dharmesh. Solution: B. Interest charged and then received on loan given: There can be a situation where the interest is charged first and then received. There will be two Journal Entries in this case 1 min read Journal Entry for Bad Debts and Bad Debts Recovered Bad Debts: When the goods are sold to customers on credit, there can be a situation where a few of them fail to pay the amount due to them because of insolvency or any other reason, and then the amount that remains unrecovered is called Bad Debts. Journal Entry: Example: Amount due from Gaurav ₹5,000 is irrecoverable as he became insolvent.Gaurav, 1 min read Journal Entry for Income Received in Advance or Unearned Income Sometimes, businesses receive money relating to the coming month or year which has not been earned yet. Such an income that has not been earned yet but has been received in advance is called Unearned Income. Unearned Income is considered to be a liability by the business. Ex- If the Commission for the month of July is received in the month of June, 1 min read Journal Entry for Loss of Insured Goods/Assets Sometimes insured goods are lost by fire, theft, or any other reason. There can be three cases related to the loss of insured goods or assets. A. Claim does not get accepted by the Insurance Company: Journal Entry: Example: Goods lost by fire ₹50,000. Insurance co. does not accept the claim.Assets lost by fire ₹20,000. Insurance co. does not accept 1 min read Journal Entry (Capital, Drawings, Expenses, Income & Goods) 1. Capital Account: The amount invested in the business whether in the means of cash or kind by the proprietor or owner of the business is called capital. The capital account will be credited and the cash or assets brought in will be debited. Journal Entry: Example: Sahil started his business with cash, furniture, and a Motorbike ₹10000, ₹20000, 3 min read Journal Entry for Cash and Credit Transactions Transactions related to the purchase and sale of goods can be of two types, Cash or Credit. A. Cash Transactions: Cash transactions are those transactions in which payment is made or received in cash at the time of purchase or sale of goods. Cash transactions can be identified by: When the Name of the Party and Cash both are given in the transactio 2 min read Journal Entry for Full/Final Settlement A business may allow or receive a discount at the time of full and final settlement of the accounts of debtors or creditors. Journal Entry: Example: 01 April 2022: Purchased goods from Sayeba at the list price of ₹10,000 at a 10% Trade Discount.05 April 2022: Returned goods to Sayeba for the list price of ₹1,000.10 April 2022: Paid cash to Sayeba ₹ 1 min read Journal Entry for Outstanding Expenses Outstanding expenses are those expenses that are related to the same accounting period in which accounts are being made but are not yet paid. Journal Entry: Example 1: Salaries due to employees ₹11,000. Solution: Example 2: Rent due to landlord ₹20,000. Solution: 1 min read Journal Entry for Sales and Purchase of Goods Goods are those items in which a business deals. In other words, goods are the commodities that are purchased and sold in a business on a daily basis. Goods are denoted as 'Purchases A/c' when goods are purchased and 'Sales A/c' when they are sold. Goods Account is classified into five different accounts for the purpose of passing journal entries: 2 min read Journal Entry for Discount Allowed and Received A discount is a concession in the selling price of a product offered by a seller to its customers. According to nature, there are two types of discount: A. Discount Allowed B. Discount Received A. Discount Allowed: When at the time of sales or receiving cash, any concession is given to the customers, it is called discount allowed. Journal Entry: Ex 2 min read Journal Entry for Sale and Purchase of Assets Assets (Machinery, Building, Land, etc.) can also be purchased or sold in cash or on credit. Assets purchased are not represented through Purchases but with the name of the Asset. Journal Entry: (When Assets are Purchased) Example: Machinery purchased for cash ₹50,000.Machinery purchased from Vishal ₹50,000.Solution: Journal Entry: (When Assets are 1 min read Opening Journal Entry After closing all the books at the end of a financial year, every business starts its new books at the beginning of each year. Closing balances of all the accounts are carried forward to the new year as opening balances. As it is the first entry in the new financial year, it is called Opening Journal Entry. Journal Entry: Example: ABC Ltd. has the 1 min read Journal Entry for Loan Taken A business can take an amount of money as a loan from a bank or outsider. In return, the business has to pay interest. A. Loan is taken from a bank or person: Journal Entry: Example: ₹10,000 was taken as a loan from the bank. Solution: B. Interest charged by the bank or person and then paid: There can be a situation where the interest is charged fi 1 min read Journal Entry for Depreciation Depreciation is the decrease in the value of assets due to use or normal wear and tear. Journal Entry: Example: Depreciation charged on machinery ₹5,000. Solution: Example: Machinery purchased for ₹20,000.Depreciation charged on machinery @10%. Solution: 1 min read Journal Entry for Capital The amount invested in the business whether in the means of cash or kind by the proprietor or owner of the business is called capital. The capital account will be credited and the cash or assets brought in will be debited. Journal Entry: Example 1: Sahil started his business with cash, furniture, and a Motorbike ₹10000, ₹20000, & ₹30000, respec 1 min read Journal Entry for Interest on Drawings The amount withdrawn from the capital by the proprietor for personal use is called drawings. Businesses can charge interest on the amount of drawings. Journal Entry: Example 1: Interest is charged on drawings ₹500. Solution: Example 2: Withdrawn cash from the business for personal use ₹5,000.Interest charged on Drawings @6%. Solution: 1 min read Journal Entry for Expenditure on Assets (Erection or Installation) Any expenditure incurred in the erection or installation of any building or machinery or any type of asset is considered to be capital expenditure and debited under the name of the particular asset. Journal Entry: Example 1: Machinery purchased worth ₹50,000 and paid installation charges ₹2,000. Solution: Example 2: Purchased building for ₹5,00,000 1 min read Journal Entry for Income Any monetary benefit arising from the business can be termed as income. Rent received, Commission received, Dividend earned, Interest received, etc are some examples of income. Income is treated as a Nominal account. Cash Account will be increased with the amount received as income, so it will be Debited and Income Account will be Credited accordin 1 min read Journal Entry for Paid Expenses Any amount spent in order to purchase or sell goods or services that generates revenue in the business is called expenses. Rent, Commission paid, Salaries & Wages Paid, Interest paid, etc are some examples of Expenses. Expenses are a part of the Nominal account. The Cash Account will be decreased with the amount paid as expenses, so it will be 1 min read Journal Entry for Drawings Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The Drawings account will be debited, and the cash or goods withdrawn will be debited. Journal Entry: Example 1: Cash and Goods are withdrawn from the office for personal use ₹500 and ₹1,000, respectively. Solution: Example 2: Paid 1 min read Journal Entry for Income Tax Income Tax is paid by the business on the profit earned during the year. Income Tax is a personal liability of the proprietor. The journal entry will be: A. Payment of Income Tax: Journal Entry: B. Refund of Income Tax: Journal Entry: Example: Income Tax paid ₹1,500.Refund of Income Tax received ₹500. Solution: 1 min read Journal Entry for Use of Goods in Business Sometimes goods of a business are used in the business itself. If this happens, those goods are considered assets by the business. Journal Entry: Example 1: A electrical goods dealer uses fans for the business worth ₹1,000. Solution: Example 2: A furniture merchant uses furniture for the business worth ₹5,000. Solution: 1 min read Journal Entry for Expenses on Purchase of Goods Purchasing process involves a number of steps starting from placing an order and ending with the delivery of goods. Apart from the cost incurred in purchasing the goods, any additional expenses like Carriage, Import Duty, etc is also paid. Any expenses incurred during the purchase of goods will be shown separately unlike an expenditure on assets. J 1 min read Journal Entry for Outstanding Salary Outstanding Salary is a liability for the firm. Outstanding salary journal entry is passed to record the salary that is due concerning the employees but not yet paid. When salary is not paid on time, it is shown under the Liabilities side of the balance as an 'Outstanding Salary' which means it has now become the liability of the firm to pay salari 1 min read Journal Entry for Prepaid Insurance Prepaid Insurance is the amount of insurance premium that the company pays in one financial year, and avails its benefit in some other financial year, generally in the upcoming financial year. Prepaid Insurance journal entry is passed to record the amount paid as advance for the insurance. Prepaid insurance is treated as the asset of the firm and i 1 min read Journal Entry for Provisions A Provision in accounting is generally some set aside profits to be used under specific contingencies. They are the reserves that are being made for specific situations and are to be compulsorily used in those conditions only. A provision is seen as an upcoming liability and should not be treated as savings. Provisions journal entry is passed to sh 1 min read Journal Entry for Rent Paid Sometimes a business does not own any specific type of property, plant, and/or machinery. They take the required asset on rent and pay the pre-specified installment for the asset in terms of cash or cheques. Rent paid journal entry is passed in order to record the necessary rent payments against rented assets. Rent is an expense for business and th 1 min readArticle Tags :

- Accountancy

- Commerce

- Commerce - 11th

Trending in News

View More- How to Merge Cells in Google Sheets: Step by Step Guide

- How to Lock Cells in Google Sheets : Step by Step Guide

- #geekstreak2024 – 21 Days POTD Challenge Powered By Deutsche Bank

We use cookies to ensure you have the best browsing experience on our website. By using our site, you acknowledge that you have read and understood our Cookie Policy & Privacy Policy

-

- System Design Tutorial

- Python Tutorial

'); $('.spinner-loading-overlay').show(); jQuery.ajax({ url: writeApiUrl + 'create-improvement-post/?v=1', type: "POST", contentType: 'application/json; charset=utf-8', dataType: 'json', xhrFields: { withCredentials: true }, data: JSON.stringify({ gfg_id: post_id, check: true }), success:function(result) { jQuery.ajax({ url: writeApiUrl + 'suggestions/auth/' + `${post_id}/`, type: "GET", dataType: 'json', xhrFields: { withCredentials: true }, success: function (result) { $('.spinner-loading-overlay:eq(0)').remove(); var commentArray = result; if(commentArray === null || commentArray.length === 0) { // when no reason is availaible then user will redirected directly make the improvment. // call to api create-improvement-post $('body').append('

'); $('.spinner-loading-overlay').show(); jQuery.ajax({ url: writeApiUrl + 'create-improvement-post/?v=1', type: "POST", contentType: 'application/json; charset=utf-8', dataType: 'json', xhrFields: { withCredentials: true }, data: JSON.stringify({ gfg_id: post_id, }), success:function(result) { $('.spinner-loading-overlay:eq(0)').remove(); $('.improve-modal--overlay').hide(); $('.unlocked-status--improve-modal-content').css("display","none"); $('.create-improvement-redirection-to-write').attr('href',writeUrl + 'improve-post/' + `${result.id}` + '/', '_blank'); $('.create-improvement-redirection-to-write')[0].click(); }, error:function(e) { $('.spinner-loading-overlay:eq(0)').remove(); var result = e.responseJSON; if(result.detail.non_field_errors.length){ $('.improve-modal--improve-content .improve-modal--improve-content-modified').text(`${result.detail.non_field_errors}.`); jQuery('.improve-modal--overlay').show(); jQuery('.improve-modal--improvement').show(); $('.locked-status--impove-modal').css("display","block"); $('.unlocked-status--improve-modal-content').css("display","none"); $('.improve-modal--improvement').attr("status","locked"); $('.improvement-reason-modal').hide(); } }, }); return; } var improvement_reason_html = ""; for(var comment of commentArray) { // loop creating improvement reason list markup var comment_id = comment['id']; var comment_text = comment['suggestion']; improvement_reason_html += `

${comment_text}

`; } $('.improvement-reasons_wrapper').html(improvement_reason_html); $('.improvement-bottom-btn').html("Create Improvement"); $('.improve-modal--improvement').hide(); $('.improvement-reason-modal').show(); }, error: function(e){ $('.spinner-loading-overlay:eq(0)').remove(); // stop loader when ajax failed; }, }); }, error:function(e) { $('.spinner-loading-overlay:eq(0)').remove(); var result = e.responseJSON; if(result.detail.non_field_errors.length){ $('.improve-modal--improve-content .improve-modal--improve-content-modified').text(`${result.detail.non_field_errors}.`); jQuery('.improve-modal--overlay').show(); jQuery('.improve-modal--improvement').show(); $('.locked-status--impove-modal').css("display","block"); $('.unlocked-status--improve-modal-content').css("display","none"); $('.improve-modal--improvement').attr("status","locked"); $('.improvement-reason-modal').hide(); } }, }); } else { if(loginData && !loginData.isLoggedIn) { $('.improve-modal--overlay').hide(); if ($('.header-main__wrapper').find('.header-main__signup.login-modal-btn').length) { $('.header-main__wrapper').find('.header-main__signup.login-modal-btn').click(); } return; } } }); $('.left-arrow-icon_wrapper').on('click',function(){ if($('.improve-modal--suggestion').is(":visible")) $('.improve-modal--suggestion').hide(); else{ $('.improvement-reason-modal').hide(); } $('.improve-modal--improvement').show(); }); function loadScript(src, callback) { var script = document.createElement('script'); script.src = src; script.onload = callback; document.head.appendChild(script); } function suggestionCall() { var suggest_val = $.trim($("#suggestion-section-textarea").val()); var array_String= suggest_val.split(" ") var gCaptchaToken = $("#g-recaptcha-response-suggestion-form").val(); var error_msg = false; if(suggest_val != "" && array_String.length >=4){ if(suggest_val.length <= 2000){ var payload = { "gfg_post_id" : `${post_id}`, "suggestion" : `

${suggest_val}

`, } if(!loginData || !loginData.isLoggedIn) // User is not logged in payload["g-recaptcha-token"] = gCaptchaToken jQuery.ajax({ type:'post', url: "https://apiwrite.geeksforgeeks.org/suggestions/auth/create/", xhrFields: { withCredentials: true }, crossDomain: true, contentType:'application/json', data: JSON.stringify(payload), success:function(data) { jQuery('.spinner-loading-overlay:eq(0)').remove(); jQuery('#suggestion-section-textarea').val(""); jQuery('.suggest-bottom-btn').css("display","none"); // Update the modal content const modalSection = document.querySelector('.suggestion-modal-section'); modalSection.innerHTML = `

Thank You!

Your suggestions are valuable to us.

You can now also contribute to the GeeksforGeeks community by creating improvement and help your fellow geeks.

`; }, error:function(data) { jQuery('.spinner-loading-overlay:eq(0)').remove(); jQuery('#suggestion-modal-alert').html("Something went wrong."); jQuery('#suggestion-modal-alert').show(); error_msg = true; } }); } else{ jQuery('.spinner-loading-overlay:eq(0)').remove(); jQuery('#suggestion-modal-alert').html("Minimum 5 Words and Maximum Character limit is 2000."); jQuery('#suggestion-modal-alert').show(); jQuery('#suggestion-section-textarea').focus(); error_msg = true; } } else{ jQuery('.spinner-loading-overlay:eq(0)').remove(); jQuery('#suggestion-modal-alert').html("Enter atleast four words !"); jQuery('#suggestion-modal-alert').show(); jQuery('#suggestion-section-textarea').focus(); error_msg = true; } if(error_msg){ setTimeout(() => { jQuery('#suggestion-section-textarea').focus(); jQuery('#suggestion-modal-alert').hide(); }, 3000); } } document.querySelector('.suggest-bottom-btn').addEventListener('click', function(){ jQuery('body').append('

'); jQuery('.spinner-loading-overlay').show(); if(loginData && loginData.isLoggedIn) { suggestionCall(); return; } // load the captcha script and set the token loadScript('https://www.google.com/recaptcha/api.js?render=6LdMFNUZAAAAAIuRtzg0piOT-qXCbDF-iQiUi9KY',[], function() { setGoogleRecaptcha(); }); }); $('.improvement-bottom-btn.create-improvement-btn').click(function() { //create improvement button is clicked $('body').append('

'); $('.spinner-loading-overlay').show(); // send this option via create-improvement-post api jQuery.ajax({ url: writeApiUrl + 'create-improvement-post/?v=1', type: "POST", contentType: 'application/json; charset=utf-8', dataType: 'json', xhrFields: { withCredentials: true }, data: JSON.stringify({ gfg_id: post_id }), success:function(result) { $('.spinner-loading-overlay:eq(0)').remove(); $('.improve-modal--overlay').hide(); $('.improvement-reason-modal').hide(); $('.create-improvement-redirection-to-write').attr('href',writeUrl + 'improve-post/' + `${result.id}` + '/', '_blank'); $('.create-improvement-redirection-to-write')[0].click(); }, error:function(e) { $('.spinner-loading-overlay:eq(0)').remove(); var result = e.responseJSON; if(result.detail.non_field_errors.length){ $('.improve-modal--improve-content .improve-modal--improve-content-modified').text(`${result.detail.non_field_errors}.`); jQuery('.improve-modal--overlay').show(); jQuery('.improve-modal--improvement').show(); $('.locked-status--impove-modal').css("display","block"); $('.unlocked-status--improve-modal-content').css("display","none"); $('.improve-modal--improvement').attr("status","locked"); $('.improvement-reason-modal').hide(); } }, }); });