I might have made a significant error by disseminating incorrect information about what constitutes a top 1% net worth in America today. Over the years, I relied on data from the U.S. Survey Of Consumer Finances, released every three years by the Federal Reserve.

According to the October 2023 Survey Of Consumer Finances, a household net worth in the top 10 percent in 2022 was approximately $7.8 million. Consequently, a top 1% net worth would exceed $13 million.

I considered the data from the Federal Reserve as unquestionable, assuming they wouldn't provide false information. However, a report from Knight Frank, a global real estate research house, has now cast doubt on the Fed's numbers.

Special promotion:If you have over $250,000 in investable assets, take advantage and schedule an appointment with anEmpower financial advisor here. Complete your two video calls with the advisor before October 31, 2024,and you'll receive a free$100 Visa gift card. It's always a good idea to get a second opinion about how your investments are positioned, especially from a professional.

A Top 1% Net Worth In America According To Knight Frank

To hold a top 1% net worth in America, according to Knight Frank, a person in 2024 must have a net worth of at least $5.8 million. This amount is at least $7.2 million lower than what the Federal Reserve believes is required to be in the top 1% net worth in America.

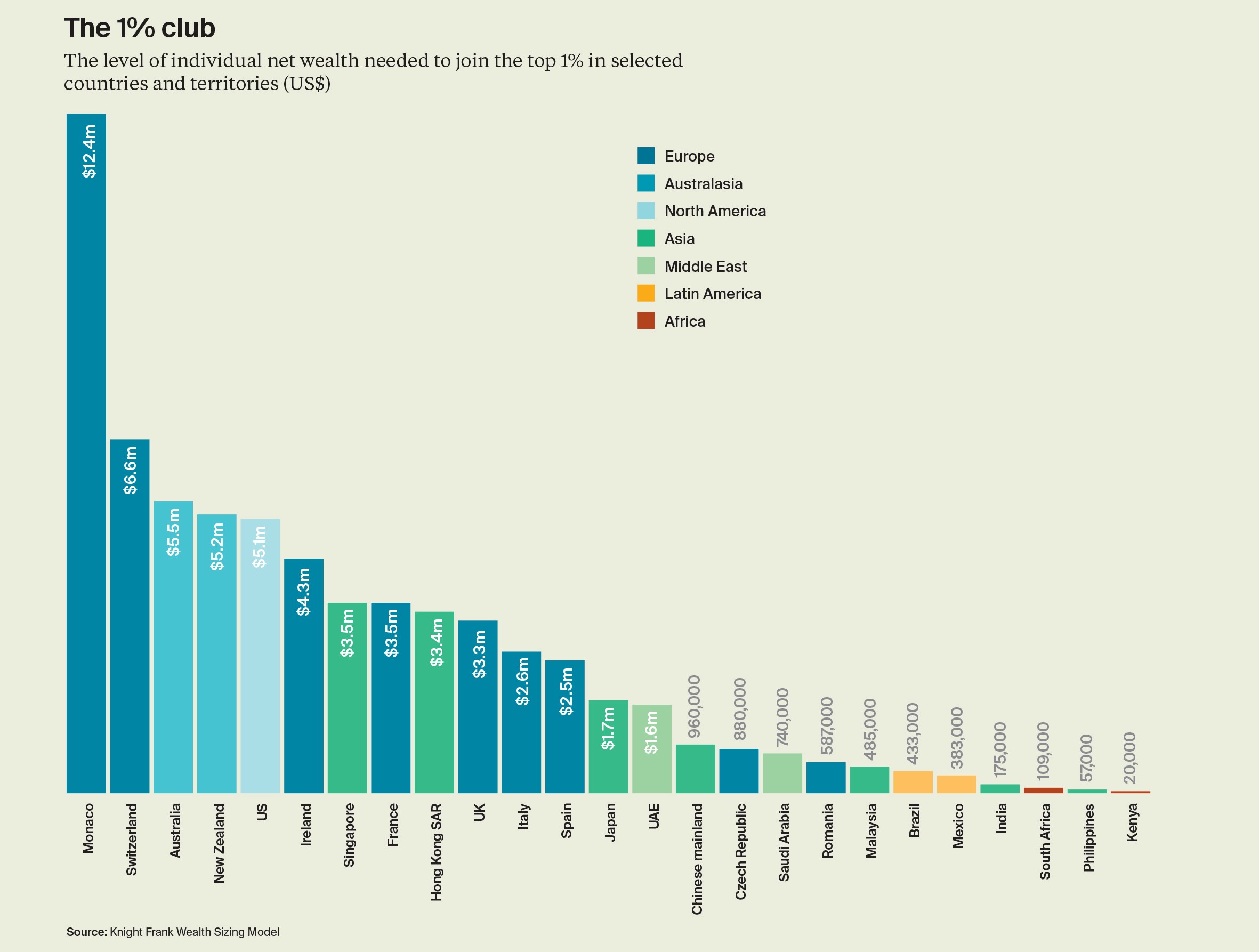

Here's Knight Frank's 2023 post and graph below on what it took to join the 1% net worth club around the world. It showed that in 2023, an American household would need a $5.1 million net worth or greater to be in the top one percent.

After seeing this data, I actually felt a huge sigh of relief! Any stress and anxiety I felt about needing to accumulate generational wealth to live comfortably in this ultra-competitive world went away. After all, I had left work in 2012 with a net worth of $3 million and it has grown along with the stock and real estate market.

I felt a similar level of relief when I read all the success stories from Financial Samurai community college graduates. No longer do I feel it is necessary for me to save $1.5 million for college for two.

A Commitment To Excellence In At Least One Thing

As a Financial Samurai, one of your goals is to strive to be in the top one percent of something, anything. Achieving a top one percent result brings an incredible amount of satisfaction given the amount of time and effort it took for you to get there.

This stretch goal doesn't necessarily have to be financially related; it can be related to sports, playing a musical instrument, earning an investment return, breaking a record, spending time with your children, or any other achievement. The goal is to push yourself to be the best at something for self-actualization purposes.

Although $5.8 million is still a lot of money to reach the top one percent in America, it sure is easier to obtain than $13+ million according to the Fed. There is now less of a need to hustle as hard, work as long, or save and invest as much if you aim to joint the ranks.

I explain the difference in the two numbers down below. Keep on reading.

Top One Percent Net Worth Levels Around The World

For 2024, Monaco retains the top spot for the highest threshold worldwide at $12.8 million ($12.4 million in 2023). I've never been to Monaco, but it appears small, nice, and perhaps a little boring. But not having to pay income taxes sounds great!

Luxembourg and Switzerland round out the top three, where one needs more than $8 million to make the cut. Switzerland's top one percent net worth threshold was only $6.6 million in 2023, so $8 million is a substantial increase.

Having been to Lucerne and Zurich in Switzerland before, I can attest that prices for food and shelter there are incredibly expensive. Prices were at least 25% more expensive than here in San Francisco, which is perennially considered one of the most expensive cities in America.

Seeing Australia and New Zealand in the top tier of countries with the highest net worth threshold is somewhat surprising. Both countries have strong retirement savings systems, and Australia has a lot of natural resources. However, I'm not sure how New Zealanders are so affluent and can afford some of the world's most expensive real estate.

Best Countries To International Geoarbitrage To Make Your Money Go Farther

Out of all the countries in the above graph, I would consider moving to Spain ($2.5M), Japan ($1.7M), Malaysia ($485K), Brazil ($433K), and The Philippines ($57K) to stretch my dollar farther. Living like a one percenter and raising a family with more financial flexibility than 99% of the population sounds appealing.

I lived in Kobe, Japan, for two years and cherished my time there. When I visit Japan, I appreciate the food, culture, cleanliness, safety, countryside, skiing, and hot springs. Besides Malaysia and Singapore, I'm not sure if there's a country in the world that prepares food better than Japan.

Having also lived in Kuala Lumpur, Malaysia, for four years, I found it to be hot and humid year-round, which may be too uncomfortable for many. However, food and housing costs are inexpensive, and the ocean-side resorts are fantastic. With a $1 million net worth, you can truly live well or spend $5,000 a month.

During business school at Berkeley, I had the time of my life studying abroad in Sao Paulo and Rio de Janeiro. The vibe in Rio felt joyful, with warm beaches, good food, lively dancing, and people who seemed to prioritize working to live.

Let's Appreciate How Good Americans Got It

Out of all the places I've visited and lived, I don't see a better country than America to build your fortune. If you're fortunate enough to live and work in America, seize the opportunity! You don't need a top one percent net worth to live a great life here.

We have a vast country brimming with possibilities. If we find one city or state less appealing, there's always the option to relocate to another. Technology has further empowered us to work for higher-paying companies while residing in more cost-effective cities. This ability to move is the main reason why I've been investing in heartland real estate since 2016.

If you want to accumulate a top one percent net worth, it's easier to do so in America than in Monaco, Australia, Switzerland, Luxembourg, and New Zealand, which have higher thresholds. These countries simply don't have the same number of job and business opportunities as we have in America.

Personally, I'm delighted to have arrived in America in 1991 for high school, pursued college, and had the chance to work in finance from 1999 to 2012. I'm even more grateful for being able to leverage the internet to pursue what I enjoy and generate supplemental income.

Who Should We Trust? The Fed Or Knight Frank?

It might seem logical to assume that the Federal Reserve possesses more trustworthy financial data on American citizens than Knight Frank, a property broker based in London, England.

However, could it be that the British have insights into American wealth that we don't? Knight Frank might also be less biased than the U.S. Federal Reserve. Or, Knight Frank might be more biased in order to make the British look relatively less poor than the Americans.

Household Wealth vs. Individual Wealth As The Difference Perhaps

Perhaps the difference in top one percent figures lies in the Federal Reserve calculating the net worth of families, whereas Knight Frank calculates the net worth of individuals. After all, two individuals generally have a larger combined net worth than one individual. If a family consists of more than two individuals working from the Fed’s perspective, then the discrepancy between the data would be even larger.

The thing is, very rarely is it 1 + 1 = 2 when it comes to calculating a top one percent net worth. For Knight Frank's top one percent net worth threshold to double from $5.8 million to $11.6 million to more closely match the Federal Reserve's estimate, a person with a top one percent net worth must also marry another person with a top one percent net worth. It happens, but clearly, it's only a small minority of cases.

Alternatively, it's possible that the Federal Reserve reports inflated figures to make more Americans feel insufficient about their financial status. By creating a perception of being poorer than we really are, the Fed could encourage more Americans to work harder and longer, generating more tax revenue.

Personally, I believe in the Fed more given I'm American. In addition, to leave no doubt about obtaining a top 1% net worth, how about shoot for a $20 million net worth!

Best Way To Build A Top One Percent Net Worth

Achieving a top one percent net worth is best accomplished through:

- Entrepreneurship

- Building a real estate portfolio with leverage

- Investing in stocks that dramatically outperform the S&P 500

- Investing in private growth companies that turn out to be multi-baggers

- Working at a high-paying job and saving and investing the majority of your money for decades

The wealthiest people in the world are almost exclusively entrepreneurs. They took outsized risks, resulting in outsized wealth. While investing in stocks, bonds, and other risk assets contributes to wealth-building, these investments are unlikely to propel you to a top one percent net worth.

To reach the top one percent, you must dramatically outperform the vast majority. This can be achieved through a combination of having a high income, aggressive saving and investing, time, and a willingness to take more risks.

The richest people I know didn't get rich by investing in index funds. Instead, once they got rich, then they invested in index funds as a way to preserve capital.

Below is a chart that shows the net worth allocation by level of wealth. Notice how the richer the individual gets, the greater the percentage of their wealth they have in business interests. This means equity in a public or private company.

The Real Top One Percent Net Worth Threshold In America

For those of you really tuned into personal finance, I suspect your gut instinct tells you that Knight Frank's $5.8 million top one percent threshold in America is too low. After all, the average American household is now a millionaire, although the median net worth is only about $200,000.

So what's the solution since nobody can really say for certain what is the exact threshold to be in the top one percent?

Like most conflicts, compromise is necessary. Therefore, I propose averaging the ongoing top net worth figures from both institutions to arrive at a truer top one percent net worth threshold figure in America.

For 2024, based on the average of the Federal Reserve's data and Knight Frank's data, the top one percent net worth in America begins at about $9.7 million. If you prefer, round up the figure up to $10 million, the ideal net worth to retire with according to thousands of FS readers.

$10+ million for a top one percent net worth in America sounds about right. Best of luck on getting richer than 99% of your fellow citizens. If you get there be sure to share what it's like!

Reader Questions

Why do you think there's such a discrepancy between the top one percent net worth thresholds reported by the Federal Reserve and Knight Frank? Who do you believe and why? What do you think is a top one percent net worth in America? Which countries would you be willing to relocate to for a wealthier life?

Loading ...

Loading ...

Invest Like The Top 1%

The wealthiest people in the world own equity in their own business and equity in other businesses. Index fund investing is a tried and true way to build wealth over time. But it's hard to outperform the masses who invest in index funds.

If you want to outperform, consider investing some of your capital toward private investments that can potentially offer more upside. Private companies are staying private for longer, which dictates investing more of your capital toward private companies to capture more of the upside.

Check out theFundrise venture capital product, which invests in private companies in the following five sectors:

- Artificial Intelligence & MachineLearning

- Modern DataInfrastructure

- Development Operations(DevOps)

- Financial Technology(FinTech)

- Real Estate & Property Technology(PropTech)

Roughly 65% of the Fundrise venture product is invested inartificial intelligence, which I'm bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI.

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what Fundrise is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

I have invested over $140,000 in the Fundrise venture product as I strive to build a $500,000 position in private AI companies. Fundrise is also a long-time sponsor as our views are aligned in real estate and venture.

With stock market volatility returning and a potential recession looming, it's more important than ever to get a financial checkup. Empower is currently offering a free financial consultation with no obligation for a limited time.

If you have over $250,000 in investable assets, don't miss this opportunity. Schedule an appointment with anEmpower financial advisor here. Complete your two video calls with the advisor before October 31, 2024, and you'll receive a free $100 Visa gift card. There is no obligation to use their services after.

A year after leaving finance, I had two free consultations with an Empower financial advisor that revealed a major blind spot. I had 52% of my portfolio sitting in cash, thinking I needed to invest like a conservative 65-year-old. The advisor reminded me that at 35, I still had many financial opportunities ahead. Within three months, I invested 80% of that cash and used the rest for a down payment on a fixer-upper—both decisions paid off well.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”).Clickhereto learn more.