There can be no better piece of information about a company than annual reports.

It may look like a collection of pages which companies send at the end of the year.

Reading it may seem to be a time consuming and a boring job.

However, it is a very valuable piece of information about a particular company.

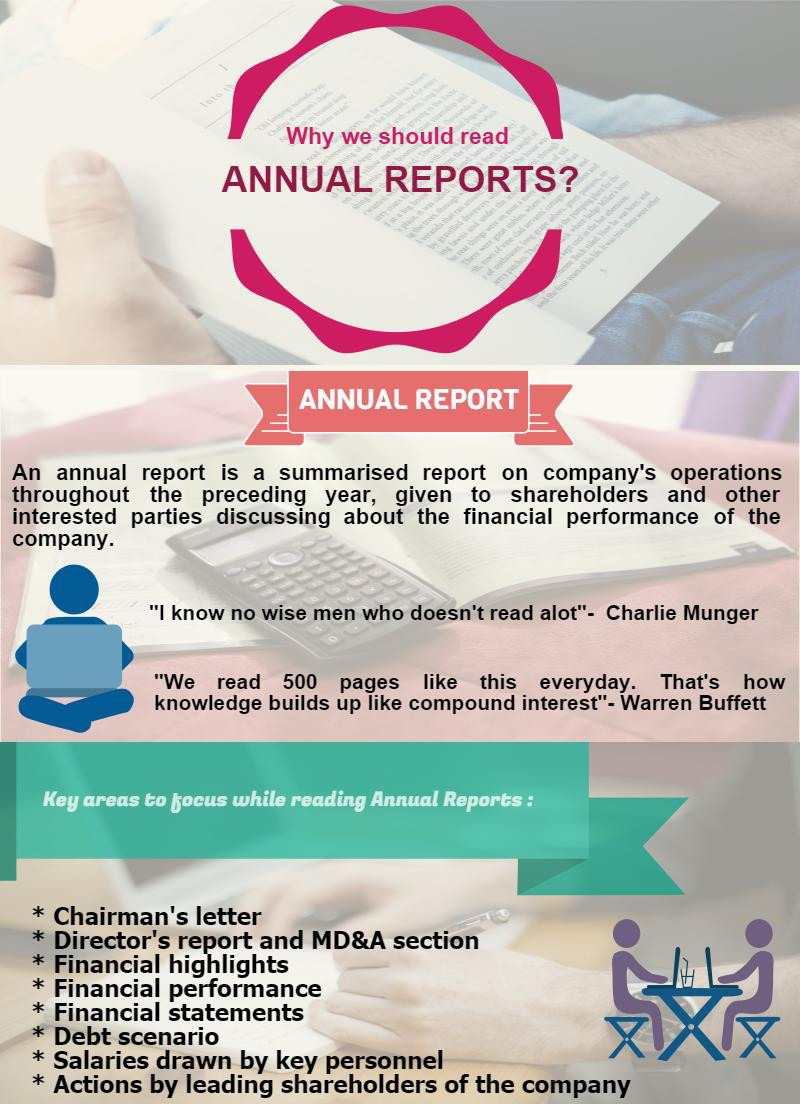

In the annual report, the company’s management discusses the important aspects about the company like industry performance, its vision for the long term, opportunities and threats faced by the company, company’s historical performance etc.

Read more:How to Evaluate management of a company

Jim Rogers, one of the finest and successful investor on Wall Street believes the same when it comes to reading the company’s annual report.

When someone asked Jim Rogers about the best piece of advice he ever got, he said it was the one he received from an old man in an airplane and the advice was “Read everything”.

Jim Rogers talks about that how you can set an edge on the vast majority of people on wall street if you simply read everything you can on a prospective investment.

“If you get interested in a company and you read the annual reports, he said you will have done more than 98% of the people on Wall street.

And if you read the footnotes in the annual report, you will have done more than 100% of the people on Wall Street.

I realized right away that if I just literally read a company’s annual report and the notes – or better yet, 4-5 years of report – I would know much more than other investors out there” said Jim Rogers.

Some of the important things which we need to focus while reading the annual report includes-

- Chairman’s letter

- Financial highlights- It gives a snapshot of the performance of the company.

- Director’s report and MD&A section

- Financial performance- It provides 10 years summarised track record

- Financial statements

Initially reading the annual report will be a tedious job and will consume a lot of your time and effort while reading the report but once you are accustomed to it, then it will not take more than 30 minutes to finish it.

Moreover reading it on a standalone basis will not give a better picture of the company so we should do inter-firm i.e. by comparing with the competitors and intra-firm i.e. by comparing with the historical performance.

For example, a company earns a net profit of Rs. 500 crore, will not give a clear picture of the company unless we compare it with respect to historical data or with its peers.

When someone invests in a company, he’s not just buying a piece of paper but is a part owner of the company no matter what quantity of shares he buys.

Register for Finance for Non-Financial Managers course that aims at giving detailed knowledge about important areas of finance starting right from basic bookkeeping to review of Annual Reports.

So we should always invest in companies whose business is clearly understood by us i.e. it should be in our circle of competence.

Warren Buffett says- “Never invest in a business you cannot understand”.

Warren Buffett always focuses on investing in a business which is very simple and easy to understand.

He says, “I try to buy stocks in businesses that are so wonderful that an idiot can run them because later, one will”.

So its very important to do our homework before investing and not after the investment is already made. This is a very big mistake which most of the people in the markets actually commits.

So the first step in doing the homework i.e. research about the company begins by reading the annual reports.

When asked how he became so successful in investing, Buffett answered: “we read hundreds and hundreds of annual reports every year.”

Warren Buffett has said that he loves to curl up with companies’ annual reports.

When asked how to get smarter, Buffet once held up stacks of paper and said he reads 500 pages like this every day.

That’s how knowledge builds up, like compound interest.

Few of the important areas where we should focus while reading annual and comparing the annual reports:-

- Debt scenario of the company

- Salaries drawn by the key personnel of the company

- Actions by the leading shareholders of the company

Bottomline:

So the important criteria to become an investor is to develop a habit of reading and the first step while analyzing any company or determining its intrinsic value, is by reading the annual report.

As Charlie Munger says, “I know no wise person who does not read a lot. I suspect that you can read on the computer now and get a lot of benefits out of it, but I doubt that it’ll work as well as reading print worked for me”.

Feel free to give your feedback to us by using the comment box below.

Keep Learning!!

Bottom Line

So the important criteria to become an investor is to develop a habit of reading and the first step while analyzing any company or determining its intrinsic value, is by reading the annual report.

As Charlie Munger says, “I know no wise person who does not read a lot. I suspect that you can read on the computer now and get a lot of benefits out of it, but I doubt that it’ll work as well as reading print worked for me”.

In order to know more about Financial Markets visit our website https://stockedge.com/

Keep Learning!!

Tags: annual reportbasicenglish